Positive Start to 2013

Sunday, February 17th, 2013February 5, 2013 — Greater Toronto Area REALTORS® reported 4,375 transactions through the TorontoMLS system in January 2013. This number represented a slight decline compared to 4,432 transactions reported in January 2012.

“The January sales figures represent a good start to 2013. While the number of transactions was down slightly compared to last year, the rate of decline was much less than what was experienced in the second half of 2012. This suggests that some buyers, who put their decision to purchase on hold last year due to stricter mortgage lending guidelines, are once again becoming active in the market,” said Toronto Real Estate Board (TREB) President Ann Hannah.

“It is interesting to note that sales were up for many home types in the GTA regions surrounding the City of Toronto. This is due, at least in part, to the additional upfront land transfer tax in the City of Toronto,” added Ms. Hannah.

The average selling price for January 2013 sales was $482,648 – up by 4.3 per cent compared to $462,655 in January 2012. The MLS® Home Price Index (HPI) Composite Benchmark price was up by 3.8 per cent over the same period.

“There will be enough competition between buyers in the marketplace to prompt continued growth in home prices in 2013. Expect annual average price growth in the three to five per cent range this year,” said Jason Mercer, TREB’s Senior Manager of Market Analysis.

Year Over Year Sales Summary GTA

2013 2012 % Chg.

Sales 4375 4432 -1.30 %

New Listings 10624 9598 10.70 %

Active Listings 14231 12290 15.80 %

Avg. Price $482,648 $462,655 4.30 %

Avg. DOM 37 32 12.90 %

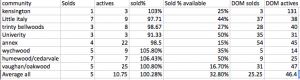

Downtown/Midtown Sales Statistics

Month of December 2012**

Dec/12 Jan/13

Properties Listed 1181 1271

Property Sales 213 229

Avg. Price $768,642 $694,373

Median Price $546,083 $528,333

** area bounded by Yonge-Ossington-Lakeshore-Eglinton